INTEGRATED FINANCE WITHOUT THE COMPLEXITY

Stimulate sales of your services

Take advantage of a short-term financing solution integrated in your customer process flows to augment transaction volumes through attractive payment options.

Boost your bottom line

Earn additional income through a value-share arrangement – without worrying about debt funding and credit risk, it’s all on us.

Grow brand engagement

Offer a unique proposition that reinforces your brand and enables further commercial opportunities through deeper customer insights.

INTEGRATED FINANCE WITHOUT THE COMPLEXITY

Stimulate sales of your services

Take advantage of a short-term financing solution integrated in your customer process flows to augment transaction volumes through attractive payment options.

Boost your bottom line

Earn additional income through a value-share arrangement – without worrying about debt funding and credit risk, it’s all on us.

Grow brand engagement

Offer a unique proposition that reinforces your brand and enables further commercial opportunities through deeper customer insights.

MAXIMISE CONVERSIONS WITH TRIVER PULSE

TRIVER Pulse is designed to streamline your workflow and help you maximise client success. With this powerful platform, our partners can effortlessly manage leads, drive conversioPulsens, and provide fast, flexible cash flow solutions to their clients.

- Instant decisions: Check eligibility and receive pre-approved offers for your clients in seconds – right while you’re on the call with them!

- Full transparency: Easily track the status of every lead in real time – no more chasing for updates.

- Monitoring performance: Keep track of the business you generate with TRIVER over time, right from your dashboard.

TRIVER Pulse makes it easy to deliver TRIVER’s seamless financing solution, helping you increase efficiency and maximise client conversions by speeding up decision-making and improving visibility.

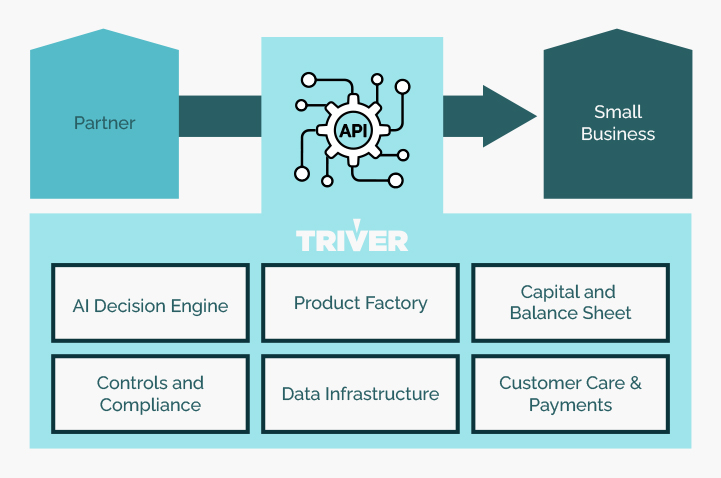

HOW PARTNERSHIPS WORK

WHY PARTNER WITH TRIVER

Great Value

Better prices and larger limits than alternatives for your clients

High Coverage

Available to small and medium size businesses across industry sectors.

Fast and Reliable

24/7 AI powered, instant digital processing with strong controls

Easy & Convenient

No-code integration within days.

Risk Free

No capital needed, no credit risk, no regulatory license needed

Customer Care

Focus on customer success and fair treatment

WHY PARTNER WITH TRIVER

Great Value

Better prices and larger limits than alternatives for your clients

High Coverage

Available to small and medium size businesses across industry sectors.

Fast and Reliable

24/7 AI powered, instant digital processing with strong controls

Easy & Convenient

No-code integration within days.

Risk Free

No capital needed, no credit risk, no regulatory license needed

Customer Care

Focus on customer success and fair treatment

PARTNER WITH US

You can partner with us if you want to offer a working capital solution via a third party and:

- You have relationships with small business clients

- Your small business clients are based in the UK and have B2B trading activities

- Your small business clients are limited companies with more than 2 years of history

You don’t need to share any customer data with us. You don’t need a regulatory license. We take care of everything and can deploy the solution under a white-labeled branding arrangement.

We can serve small business clients from any industry sector and welcome partners from various domains, for instance:

SME SAAS SERVICES

If you are offering services to SMEs such as accounting tools, you can enrich your offering, help your clients and make additional income with TRIVER.

BANKS

If you offer bank accounts to SMEs, you can rapidly expand your product offering, go fully digital, increase loyalty and income, and potentially also deploy your own capital to maximise returns.

CORPORATE PROCUREMENT

If you provide corporate procurement or supply chain tools, you could embed our solution to fully support all SME suppliers and generate incremental income.

We can serve small business clients from any industry sector and welcome partners from various domains, for instance:

SME SAAS SERVICES

If you are offering services to SMEs such as accounting tools, you can enrich your offering, help your clients and make additional income with TRIVER.

BANKS

If you offer bank accounts to SMEs, you can rapidly expand your product offering, go fully digital, increase loyalty and income, and potentially also deploy your own capital to maximise returns.

CORPORATE PROCUREMENT

If you provide corporate procurement or supply chain tools, you could embed our solution to fully support all SME suppliers and generate incremental income.

SOME OF OUR 60+ PARTNERS