FOR ACCOUNTANTS

EMPOWER YOUR CLIENTS WITH FAST, FLEXIBLE FUNDING

TRIVER helps your clients access the funds they need – in minutes, not hours, not days or weeks. No paperwork, securities or personal guarantees. No hassle. Just fast, flexible funding with no admin burden.

Interested in partnering?

Tell us who you are and we’ll show you how to get started.

We’ll only use your info to contact you about the partner programme.

FOR ACCOUNTANTS

Empower your clients with fast, flexible funding

TRIVER helps your clients access the funds they need – in minutes, not hours, not days or weeks. No paperwork, securities or personal guarantees. No hassle. Just fast, flexible funding with no admin burden. As a partner, you stay in control and strengthen your advisory value by solving your clients’ cash flow challenges.

Interested in partnering?

Tell us who you are and we’ll show you how to get started.

Interested in partnering?

Tell us who you are and we’ll show you how to get started.

We’ll only use your info to contact you about the partner programme.

WHY PARTNER WITH TRIVER?

You’re your client’s first stop for financial clarity. With TRIVER, you can help them unlock working capital through AI-powered invoice finance. Faster, more flexible, and less burdensome than a traditional loan.

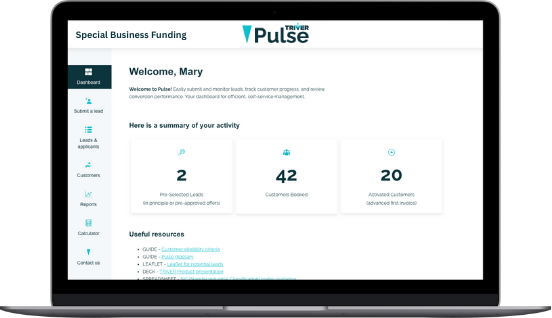

You stay in control with full visibility via TRIVER Pulse, while your client gets paid instantly and repays when their customer does.

Fees are handled automatically by direct debit, so there’s no admin or chasing needed.

WHY PARTNER WITH TRIVER?

You’re your client’s first stop for financial clarity. With TRIVER, you can help them unlock working capital through AI-powered invoice finance. Faster, more flexible, and less burdensome than a traditional loan.

You stay in control with full visibility via TRIVER Pulse, while your client gets paid instantly and repays when their customer does.

Fees are handled automatically by direct debit, so there’s no admin or chasing needed.

Frictionless

auto-repaid, fully accounting-integrated

Simple

no personal guarantee, no securities, no paperwork

Discreet

no trust account, no buyer involvement

Flexible

large facility that grows with your clients’ businesses

Fair

low daily fee per transaction, no hidden fees

Convenient

available to use online 24/7, whenever your client wishes

Frictionless

auto-repaid, fully accounting-integrated

Simple

no personal guarantee, no securities, no paperwork

Discreet

no trust account, no buyer involvement

Flexible

large facility that grows with your client’s business

Fair

low daily fee per transaction

Convenient

available to use online 24/7, whenever your client wishes

FAST, TRUSTED AND BUILT TO FIT YOUR WORKFLOW

TRIVER integrates seamlessly with your client’s accounting software and bank account via Open Banking. That means:

- Instant decisions – advance approvals in real time

- Fast funding – cash arrives in seconds

- Automated reconciliation – no manual entry or chasing

We fund up to 99% of eligible invoice values, with transparent fees and automated repayments – making cash flow simple, fast, and fully integrated.

OUR PRICING IS SIMPLE

Your clients only pay when they use it. A simple discount fee is applied per transaction based on their invoice value — typically 0.06% per day (for example, 1.8% over 30 days).

- No setup fee

- No interest

- No prepayment penalties

- Free when not used

They can stop and start their facility at any time.

FREQUENTLY ASKED QUESTIONS

TRIVER offers cash flow financing to small businesses, leveraging unpaid client invoices. This service is called invoice discounting. Your TRIVER facility enables you to advance invoices whenever needed, up to the facility limit, and you only pay for what you use.

Invoice discounting is way to generate instant cash flow from your client invoices by advancing their payment instead of taking new debts. Unlike invoice factoring, you can select the invoices you wish to advance and the use of the facility is invisible to your clients.

You can advance as many invoices as you want between £1,000 – £100,000, up to your facility limit.

Commercial invoices in Pound Sterling, made to UK companies or public sector entities (not to consumers or sole-traders) registered in the UK, that have payment terms of 10 days or more.

Your repayment to TRIVER is collected via a one-off direct debit scheduled a few days after your invoice due date, providing you time to receive payments from your client. We will give you advance notice before your repayment is collected.

Yes, you can make an early repayment to TRIVER if your client pays you early. The cost of the transaction will be adjusted accordingly. You only pay for what you use, there is no early repayment fee.

If your client’s payment is delayed, you can request a repayment extension with TRIVER. Once approved, your direct debit will be rescheduled, and the transaction cost adjusted to reflect the new terms. Extensions are available for up to 120 days from the original invoice funding date. After that period, you’ll be required to repay TRIVER, even if your client hasn’t paid you.

No paperwork, no personal guarantees. We only need your company name, the applying Director’s details and your permission for a read-only connection to your business bank account via Open Banking.

As part of assessing your application for opening a facility with TRIVER, we ask credit reference agencies for your company’s credit data. This data request is called a ‘soft search’. Soft searches are only visible to you and the credit reference agency. They are not visible to other lenders and don’t affect your company’s credit score. A ‘standard’ search, also known as ‘hard’ search, that gets registered in your credit file is only performed once you have received and accepted an offer from TRIVER.

No. Directors’ credit scores are not impacted. There will only be a ‘soft’ search on the applicant Director’s credit file that does not leave a mark on their credit records.